I'm trying to be a responsible 20, almost 30-somethingm and get my (negligible amount of) money in order. So far this has meant establishing my retirement account (or, rather, reactivating it after putting it on hold for law school), learning the difference between an IRA and a Roth IRA, reading Suze's Women & Money, and being better about budgeting. I've also recently joined Mint.com. I was nervous about putting so much financial info in one place but friends have raved about it, and it is great to see everything at once and set some clear goals. If you've used Mint, or similar programs, let me know how it's worked for you!

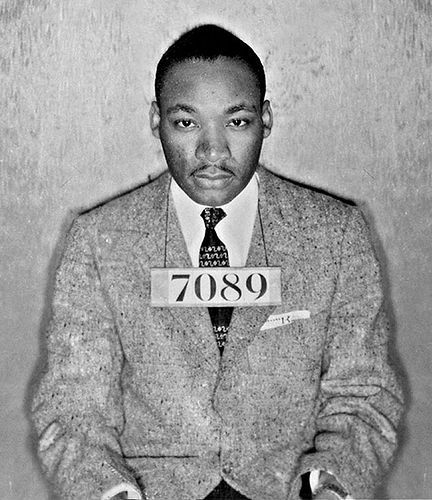

I'm trying to be a responsible 20, almost 30-somethingm and get my (negligible amount of) money in order. So far this has meant establishing my retirement account (or, rather, reactivating it after putting it on hold for law school), learning the difference between an IRA and a Roth IRA, reading Suze's Women & Money, and being better about budgeting. I've also recently joined Mint.com. I was nervous about putting so much financial info in one place but friends have raved about it, and it is great to see everything at once and set some clear goals. If you've used Mint, or similar programs, let me know how it's worked for you!Image: source. Here are more wonderful photos of King.

Ooooh, a whole cookbook on quinoa? I'm listening...

I always love the annual NYTimes section The Lives They Lived.

Today's planned workout: 5 mi run.

Today's actual workout: I'm headed to the gym after work for the 5 mi run, and planning to follow it up with a 20 min swim. Go go go! I'm so excited for my half-marathon this weekend. Update: got in 5.5 miles on the treadmill, and 40 min on the bike.

“Knowing how to be solitary is central to the art of loving. When we can be alone, we can be with others without using them as a means of escape.” - bell hooks, All About Love: New Visions

2 comments:

I really love the idea of Mint.com but since my student loans (my largest chunk of debt) are through a a very tiny loan corporation it wouldn't recognize them or let me add them otherwise. Kind of a bummer!

Yeah, it didnt recognize my local credit union either...

Post a Comment